Private equity in its most profitable form

Secondaries enable the entry into the profitable phase.

There are tens of thousands of private equity funds worldwide, predominantly held by institutional investors. Due to their terms of at least 10 years, a premature sale due reallocation or liquidity needs is only possible via the secondary market. After a detailed due diligence, review and evaluation the investment decision is being made.

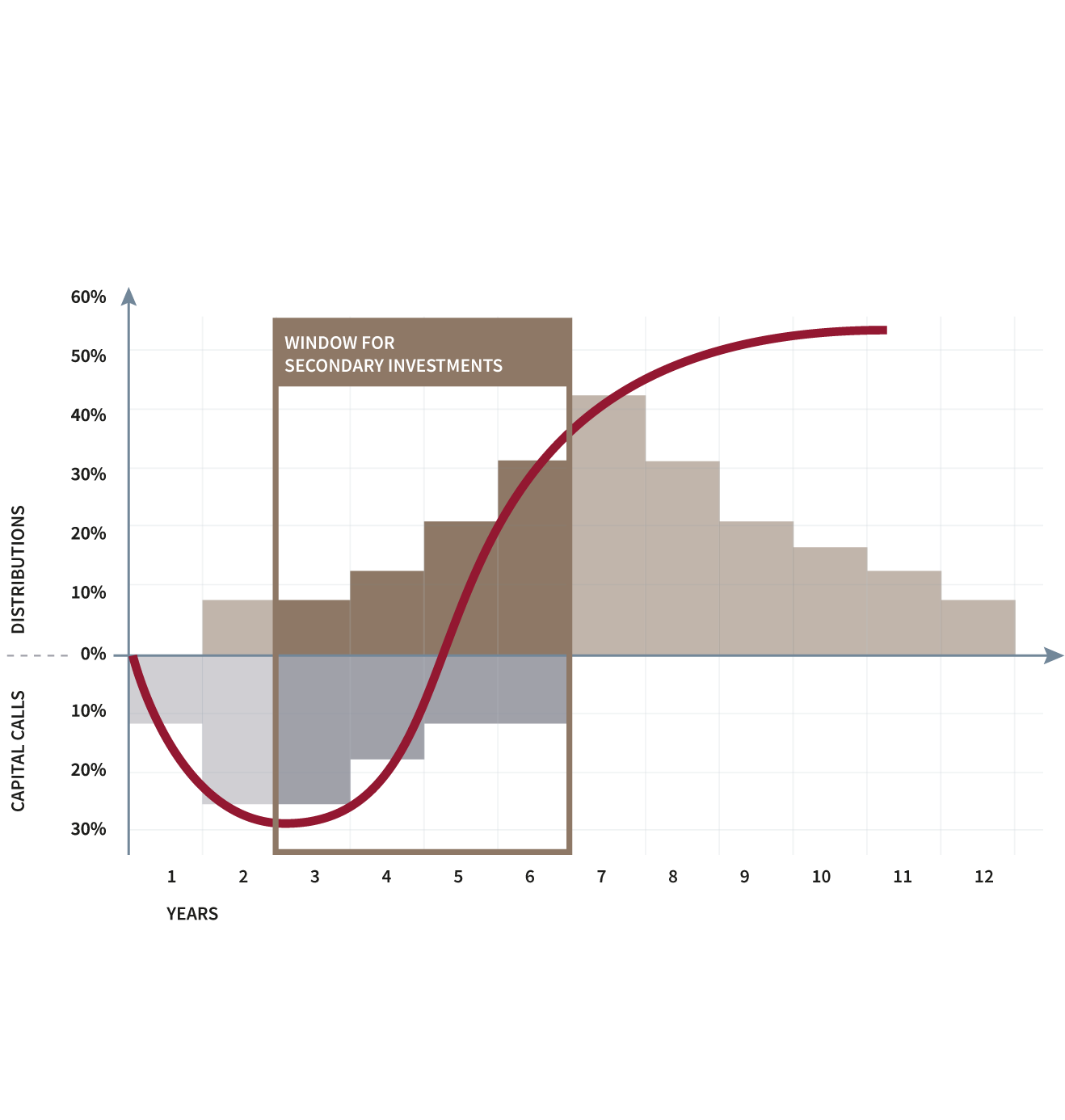

The life cycle of a private equity investment

The J-curve outlines the development of the cash flow of a private equity investment. In the first phase, this curve is still characterised by start-up costs, which are initially hardly offset by any distributions.

However, the J-curve is softened with secondary private equity investments. Investments acquired via the secondary market are generally already in the profitable phase. With this secondary strategy, Matador AG enables its shareholders to achieve above-average returns.

Picture: Private Equity J-Curve

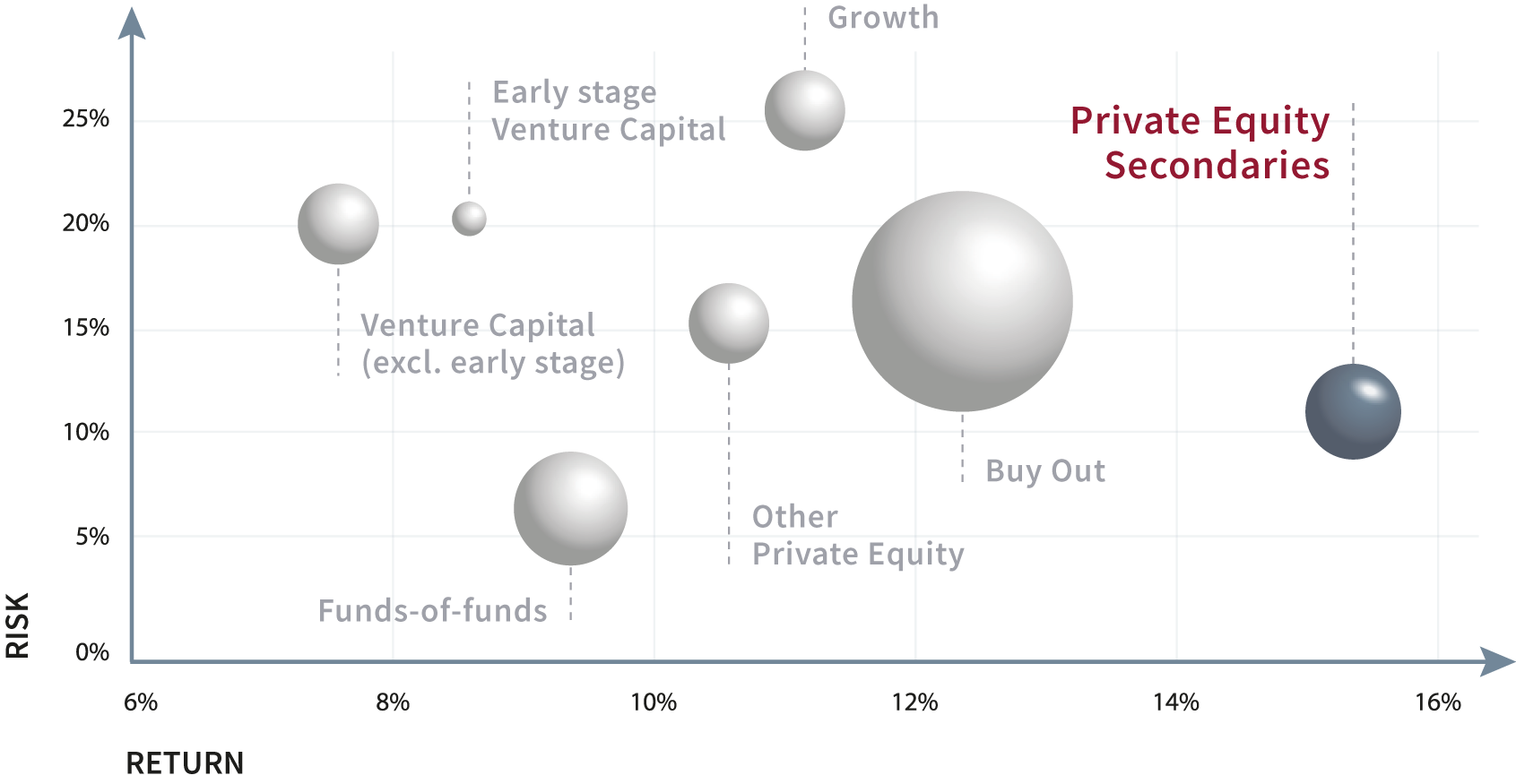

Secondary private equity stands out with an optimal risk/reward ratio

As this chart shows, secondaries are the highest-yielding asset class in the private equity market with very low risk.

Figure: Risk-return profile of PE strategies