Less risk, more fun: private equity for everyone – Going Public Magazine

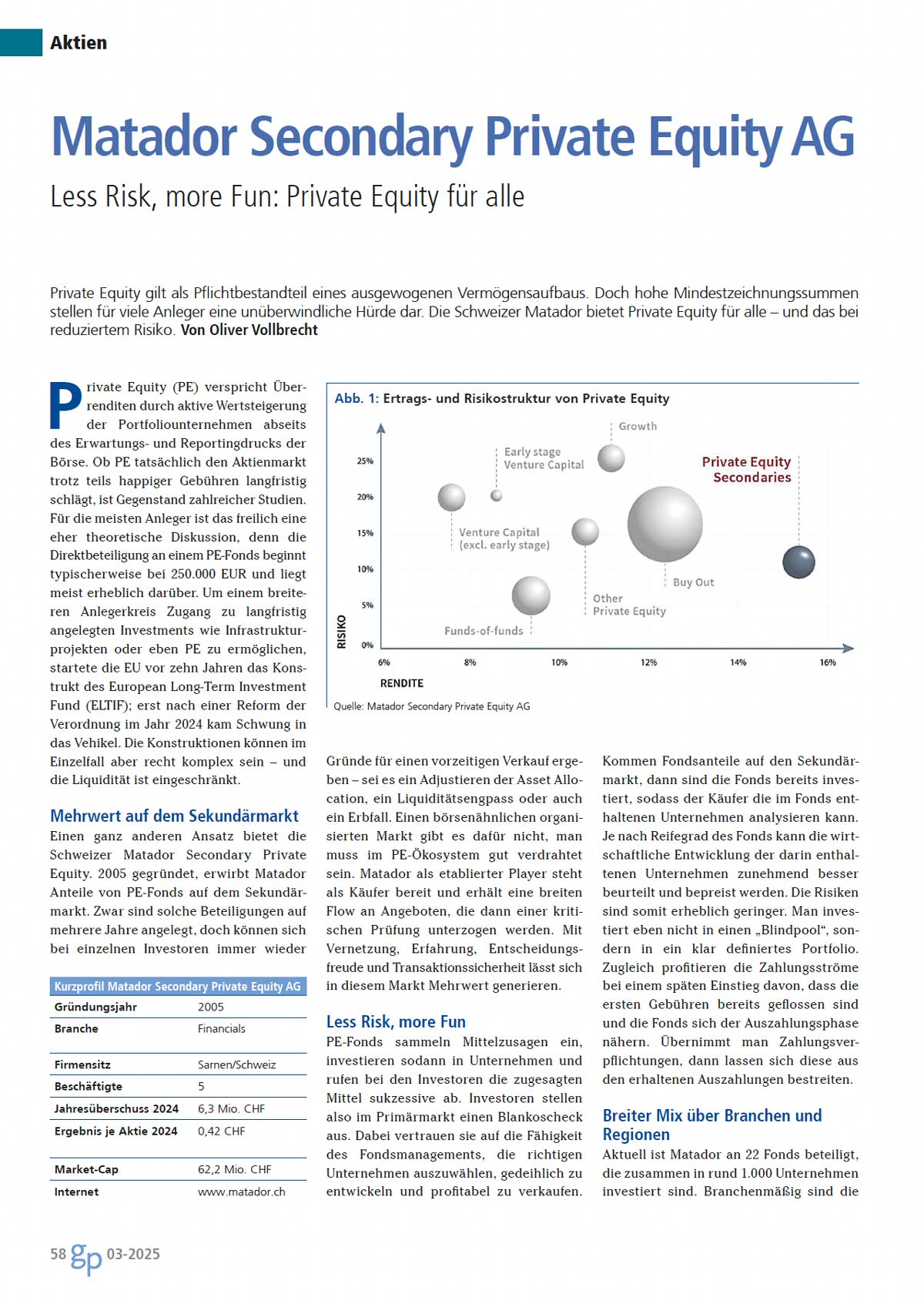

Published in Going Public Magazine Private equity is considered a mandatory component of balanced asset accumulation. However, high minimum subscription amounts represent an insurmountable hurdle for many investors. The Swiss Matador offers private equity for everyone - with reduced risk. Private equity (PE) promises excess returns by actively increasing the value of portfolio [...]