Published in Going Public Magazine

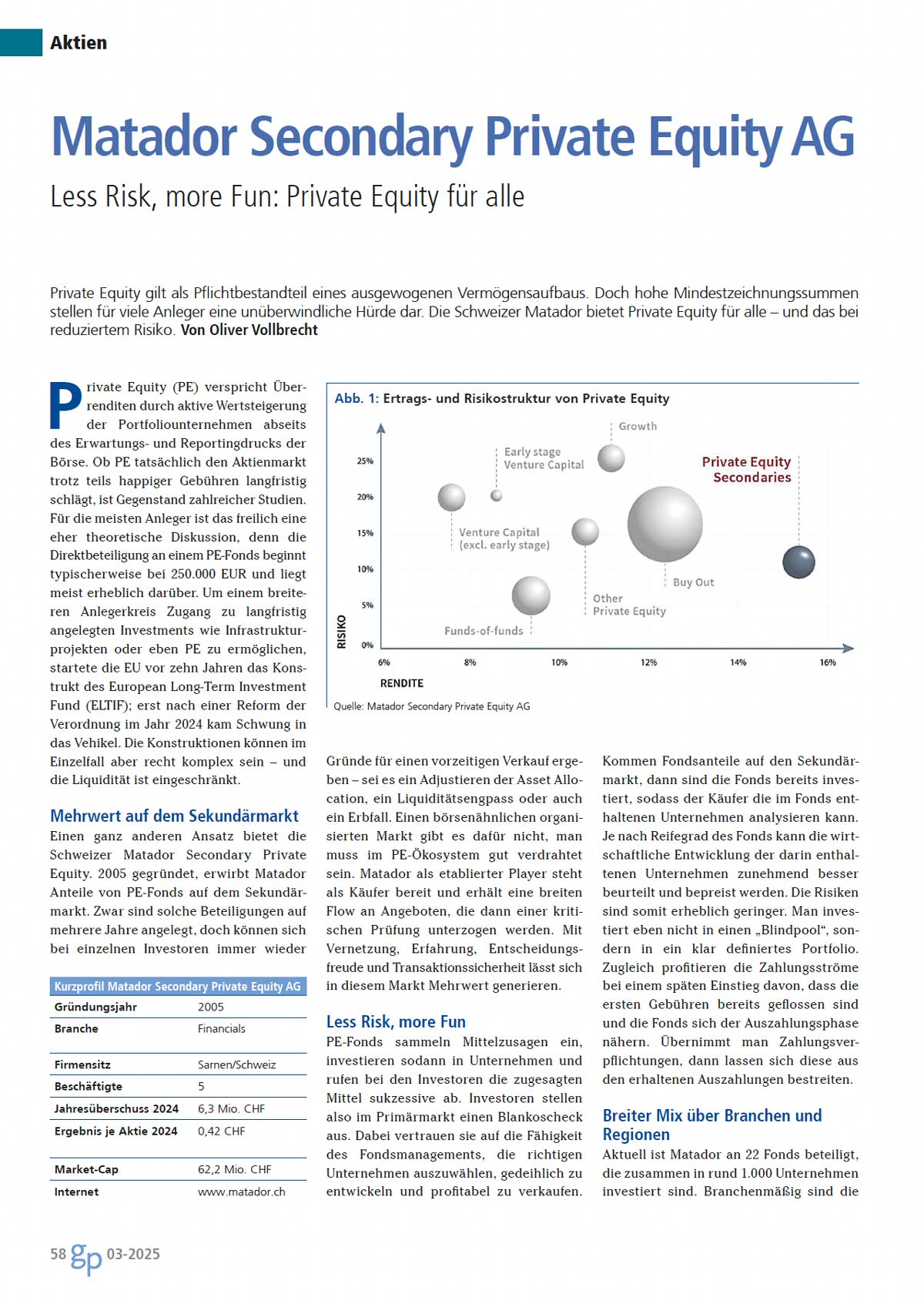

Private equity is considered a mandatory component of balanced asset accumulation. However, high minimum subscription amounts represent an insurmountable hurdle for many investors. The Swiss Matador offers private equity for everyone – with reduced risk.

Private equity (PE) promises excess returns by actively increasing the value of portfolio companies away from the expectation and reporting pressure of the

stock market. Whether PE actually beats the stock market in the long term despite sometimes steep fees is the subject of numerous studies.

For most investors, however, this is a rather theoretical discussion, as direct participation in a PE fund typically starts at EUR 250,000 and is usually considerably higher. Ten years ago, the EU launched the European Long-Term Investment Fund (ELTIF) to give a broader group of investors access to long-term investments such as infrastructure projects or PE; the vehicle only gained momentum following a reform of the regulation in 2024. However, the structures can be quite complex in individual cases – and liquidity is limited.