Matador Secondary Private Equity AG

in the media

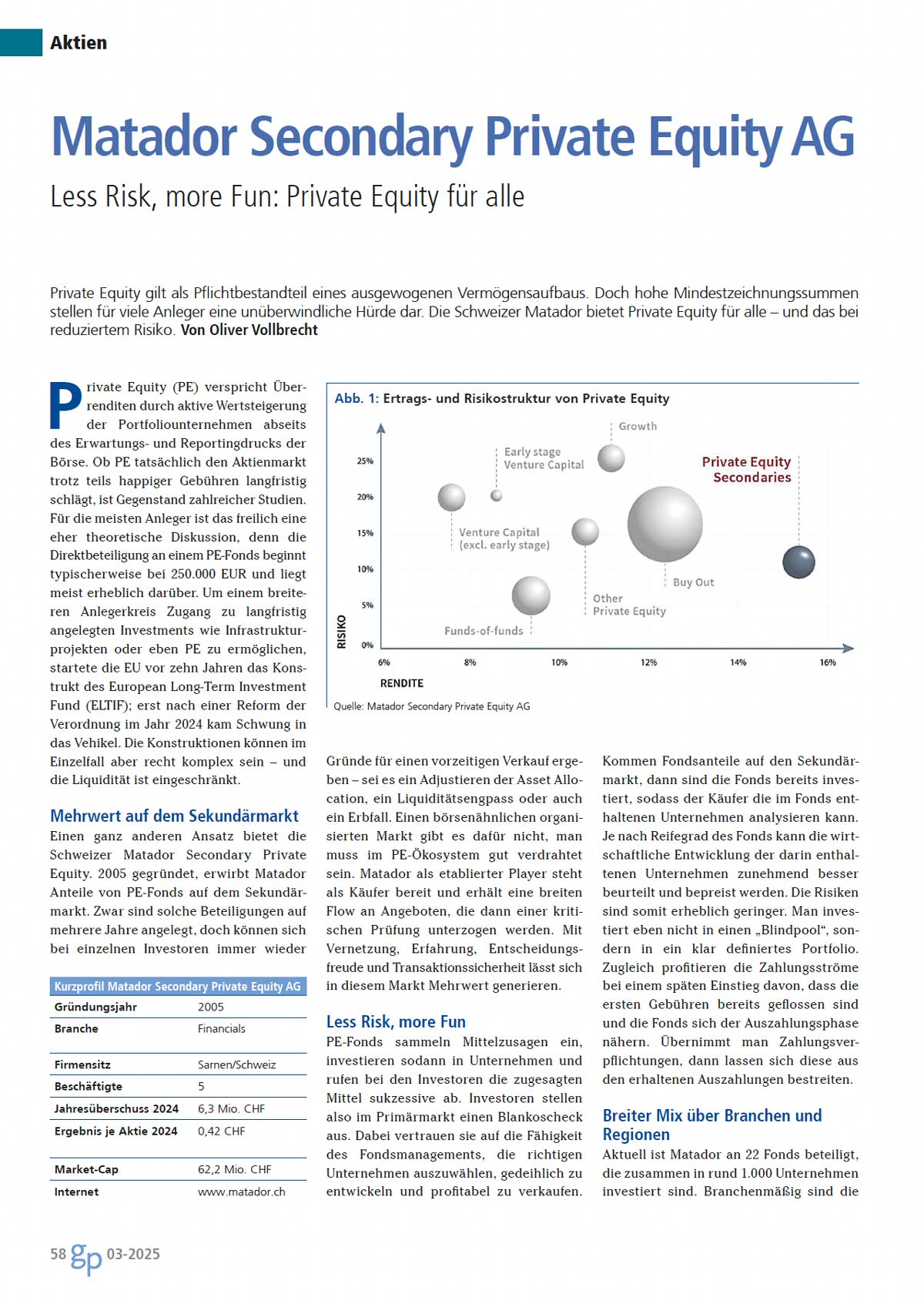

Less risk, more fun: private equity for everyone – Going Public Magazine

Published in Going Public Magazine Private equity is considered a mandatory component of balanced asset accumulation. However, high minimum subscription amounts represent an insurmountable hurdle for many investors. The Swiss Matador offers private equity for everyone - with reduced risk. Private equity (PE) promises excess returns by actively increasing the value of portfolio [...]

Talking Heads – Florian Dillinger, Matador AG, in conversation: In the sweet spot of secondaries

Published in ALTERNATIVES INDSUTRIES Secondaries play a special role within private equity, even for smaller players. The CEO of Matador Secondary Private Equity AG talks to ALTERNATIVES!INDUSTRIES - about opportunities and discounts, falling interest rates and rising prices, the overweighting of the USA, Donald Trump and more ... > read more [...]

FAZ special supplement: Private equity in transition

Published in the ePaper INVESTMENT GUIDE from erfolgundbusiness.de In this interview, Dr. Christof Schlindwein, fund manager of Porta Equity ELTIF, and Dr. Florian Dillinger, Chairman of the Board of Directors of Matador Secondary Private Equity AG, talk about the transformation in the private equity market and new opportunities for private investors. > Read more [...]

Secondary private equity – if not now, then when?

Published in the ePaper FINANZEN from erfolgundbusiness.de Private equity is an asset class that has proven to be extremely lucrative and promises double-digit returns. Despite the enormous challenges currently facing the global economy, the private equity industry has successfully maintained its position in 2023. Building a private equity portfolio requires considerable effort, hard work [...]

Secondaries first: Why there is a lot to be said for Matador Secondary Private Equity AG and the secondary market right now

Published in the Investment Guide in the FAZ The early bird catches the worm, but the second mouse gets the cheese - both also apply to private equity. Those who invest directly in a successful company or in a newly launched venture capital or private equity fund achieve the highest increases in value. [...]

“Secondaries are the highest-yielding asset class in the private equity market”

Published Issue 4/2022 Entrepreneur Edition Interview with Dr. Florian Dillinger, CCEO, Matador Secondary Private Equity AG In times of higher interest rates and high uncertainty on the stock markets, traditional portfolios of shares and bonds no longer work as well as in the past. Alternative strategies are therefore increasingly in demand. We spoke [...]

Secondary Private Equity – Private Wealth Magazine

Published in Private Wealth Magazine, December 2021 Secondary Private Equity. In times of low interest rates and high valuations on the stock markets, traditional portfolios of shares and bonds no longer work as well as they did in the past. "I therefore recommend restructuring your portfolio," explains Florian Dillinger, Matador Partners Group: "Private equity, [...]

Invest it like Yale.

Published in Private Wealth Magazine, December 2020 Secondary Private Equity. Many large investors are so successful because they hold a high proportion of private equity in their portfolios over the long term. "Even for wealthy private investors and smaller family offices, however, this is not so easy to implement," explains Florian Dillinger, Matador [...]

No longer a niche: “There are several reasons for investing in private equity at the moment”

Published February 19, 2020 Market Commentary Dr. Florian Dillinger, Chairman of the Board of Directors of Matador Partners Group Admittedly, 2019 was a year in which the private equity sector as a whole presented a rather mixed picture, at least in terms of its public image. This impression was mainly created by the [...]

When opportunity knocks.

Published in Private Wealth Magazine, December 2019 Private equity and infrastructure. "We actually specialize in secondary market funds in the private equity sector," explains Florian Dillinger, Matador Partners Group AG. But when a special opportunity arises, he invests in infrastructure. This combination of both asset classes holds a special charm for the investment [...]

Secondary private equity as a long-term champion

Venture Capital Magazine - Special Section December 2019 A quick question: How much return do you think is realistic given the ECB's ongoing zero interest rate policy? And how much return are you aiming for with your investments? 3%? 4%? Or even 7%? How about just under 14%? Sounds unrealistic, but it is [...]

Small is beautiful.

Private Wealth - Special Publication: Matador Partners Group AG on May 15, 2019 Private equity. Many PE funds are sitting on a mountain of capital. They are competing with each other to buy companies, driving up prices . "We are therefore increasingly focusing on smaller companies. There are more investment targets and far [...]

Second hand, first class.

Published in Private Wealth Magazine, December 10, 2018 Secondary Private Equity. Because private equity funds have been generating double-digit returns for years, this asset class is becoming increasingly popular among wealthy investors. But it gets even better. "Used fund shares - secondary private equity - are just as profitable and avoid the main disadvantages [...]

Interview with Florian Dillinger, Chairman of the Board of Directors of Matador Partners Group

Published on moneycab - September 26, 2018 Moneycab.com: Mr. Dillinger, some private equity firms are currently making great efforts to attract more private and retail investors to this asset class. Do you also have to do a lot of educational work or do your potential clients already know all about it? Florian Dillinger: [...]

Not just for professionals

Published in Going Public Magazine - August 2018 The investment market is increasingly opening up to private investors A study shows: The private equity market will grow to €10 trillion by 2025. USD fourfold. The asset class attracts investors with high and stable returns - even during financial crises. With new ideas, the [...]

Two become one

Published in Nebenwerte Journal - June 2018 MPG AG, which was formed following the merger of Matador Partners Group and Matador Private Equity, specializes in secondary private equity. With equity capital of CHF 30.7 million or € 26.5 million, the company is well positioned for the start. Further capital rounds, ideally at higher [...]

Private equity also for private investors

Published on 4investors - 24.01.2018 Private equity as an asset class has long been neglected by private investors. This has changed - partly because there are now very good opportunities to get involved in this area. Few industries have seen as much change over the past two decades as the investment sector. Private [...]

Power plant operator becomes a recycling company

Publication in a special of Venture Capital Magazine - July 2017 (page 24-25) Up to now, Austria has also relied on feed-in tariffs to promote green electricity. However, these will be renegotiated. The operators of the wood-fired power plant would like to decouple themselves to some extent from legally regulated feed-in tariffs and [...]

Private equity in Switzerland

Publication in: VentureCapital Magazine - April 2017 (pages 4-8) Switzerland as an ideal buyout location Sarnen-based Matador Private Equity AG is an asset manager that invests primarily in private equity and infrastructure. "Our target funds are generally reserved for institutional investors," says Dr. Florian Dillinger, Managing Partner at Matador. "We want to give [...]

A secondary market with first-class prospects

The Foundation - Issue 3/17, June 2017 (page 52-53) In order to continue generating adequate returns in times of low, zero or penalty interest rates, one in three foundations already invests more than 20 percent of its assets under management in private equity. However, the PE market is increasingly considered to be overheated. [...]