Welcome to the private equity secondary market.

Matador invests in private equity secondaries.

What exactly does that mean?

Private equity investments are investments in companies not traded on the stock exchange. If an investor wishes to sell an existing private equity investment prematurely in order to gain liquidity or restructure the portfolio, this can only be done via the so-called secondary market.

And this is precisely where Matador AG invests: in private equity secondaries.

Matador AG invests in secondary private equity.

So do our shareholders.

Matador offers shareholders all the advantages of a private equity investment.

And even more.

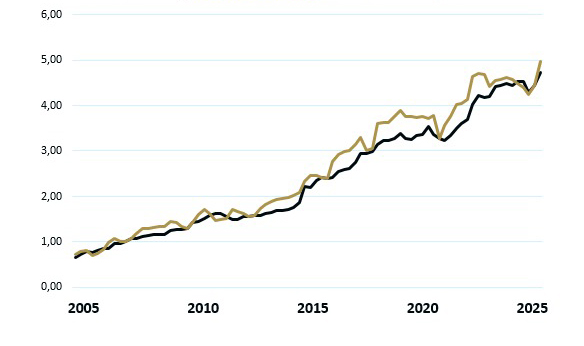

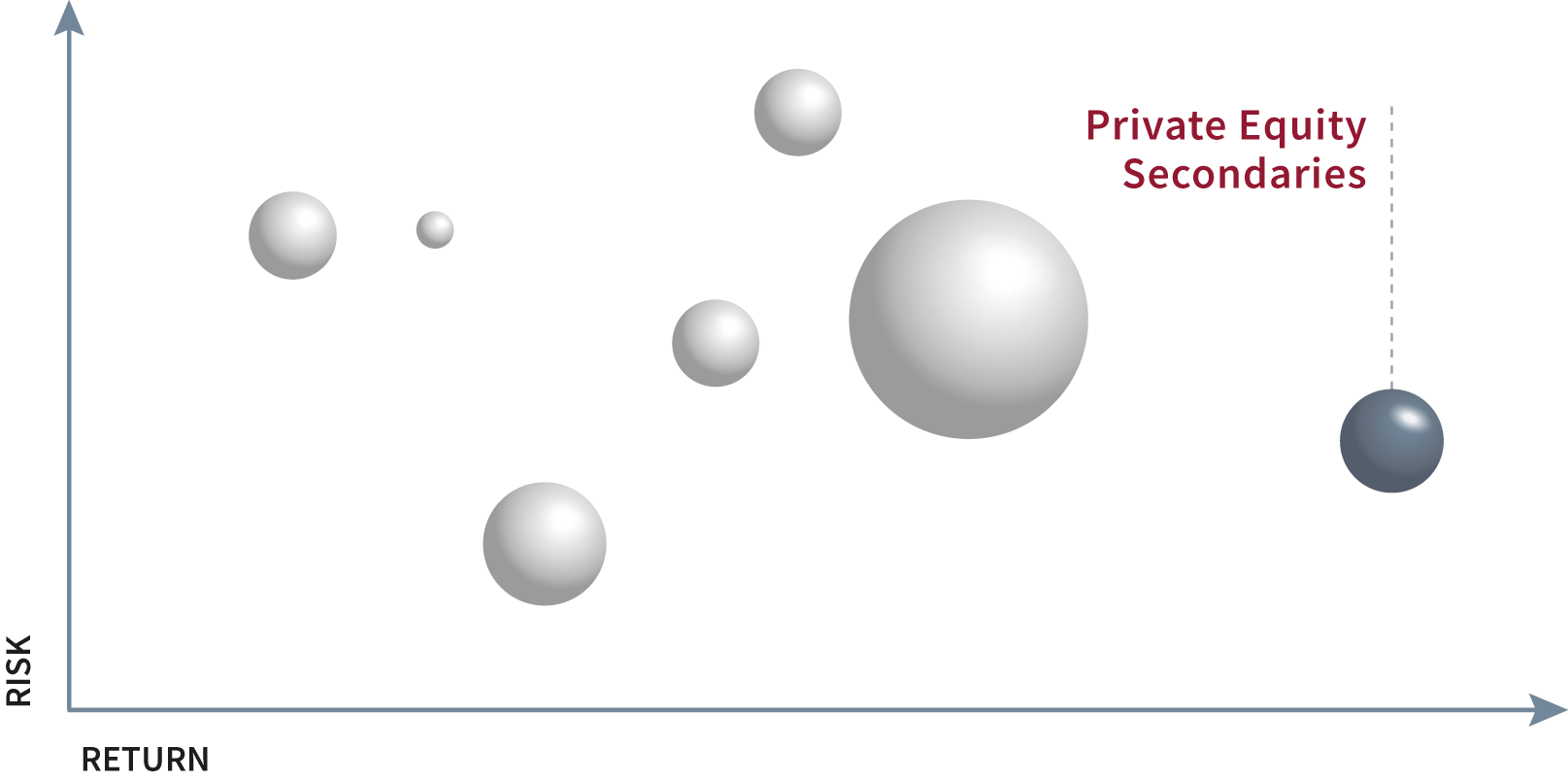

Private equity are investments in companies that are not traded on the stock exchange. This makes them, among other things, crisis-proof tangible assets that achieve above-average returns. Matador Secondary Private Equity AG invests in this segment and opens up new opportunities for investors with our shares.

The private equity market is valued by investors as an investment with comparatively high returns. However, the entry barrier is high. Normally, a private equity investment of less than CHF 5 million is hardly possible. In addition, this money is usually tied up for at least 10 years. With Matador shares, investors can participate in a broadly diversified private equity portfolio. With any investment volume and immediate liquidity.